Put your LINEA tokens to work ahead of Status Network launch

The LINEA pre-deposits vault opened last month, and already 50M+ LINEA tokens are deposited and earning rewards and liquid yield as Status Network mainnet launch approaches.

If your LINEA is still idle, the real question is: what are you waiting for?

Status Network is a gasless zkEVM L2 built on the Linea stack and part of the Linea Consortium. Status Network is a fully gasless execution layer with composable privacy for humans and bots, powered by native yield.

The pre-deposit phase is how Status Network kickstarts its economy ahead of mainnet. By depositing LINEA, you can:

- accrue Karma, the core governance and reputation token of the L2

- earn liquid rewards in SNT (40%+ APY as of January 20)

- be early on points from Status Network native apps

Deposits will unlock at mainnet launch (targeting end of March) directly on Status Network, along with Karma and the liquid rewards.

The LINEA pre-deposit vault is the first vault on Linea L2 designed to support pre-mainnet capital commitment with governance and incentive accrual carried through launch. As of January 20, more than 50m LINEA tokens have been deposited.

Gas has traditionally been a way for chains to reduce spam and earn revenues. But this model adds considerable friction to the user and developer experience while leaking information and ultimately still allowing spam as gas costs trend to zero.

Status Network is building a chain where execution is based on reputation, not gas. The higher your reputation, the higher your free transactions throughput. Reputation (represented by the Karma balance) is earned by providing liquidity to the network and developing and using apps on the L2.

On Status Network, execution is funded by bridged yield and native app fees, not by charging users per transaction. Users do not need ETH to get started, apps can onboard instantly, and the chain monetises assets under management and volume rather than network congestion fees.

That alone flips incentives. But the deeper impact is on privacy.

Gas requirements create unavoidable onchain trails:

- funding transactions

- gas top-ups

- timing correlations

- account reuse

Gasless breaks this.

Because users don’t need gas:

- Ephemeral accounts become viable, with no funding history

- No funding trails link identity to activity

- Ephemeral relayers and session key accounts are native, not hacks

- Noise transactions can be created for free unlocking much larger anonymity sets

- Delayed and batched execution reduces timing leaks

In gas-based systems, privacy is bounded by economics. In Status Network’s gasless system, privacy is enhanced by economics: private balances can be used in native DeFi apps, unlocking private yield, swaps, liquidity provision, lending and borrowing, fundraising, etc, all without leaving gas trails.

Karma is a game changer - and you’re still early

To provide free transactions at scale, Status Network relies on a soulbound reputation token: Karma. Karma can only be earned by positively contributing to the network (staking, providing liquidity, building and using apps) and has two super powers:

1- it’s your key to free transactions: the higher your Karma balance, the higher your daily quota of free transactions

2- it’s your direct power over the native yield pool: all revenues from bridged yield and native app fees accumulate in the funding pool and Karma holders vote on the allocations to incentivise liquidity and fund apps on the network

Because Karma cannot be bought or farmed and dumped, early participation matters disproportionately:

- Karma share is relative, not absolute - what matters is your voting power

- Early contributors earn lasting governance weight

This creates an economy where capital, yield, and governance are structurally aligned.

If you plan to use, build on, or allocate capital within Status Network, or just want to experiment with the first natively gasless blockchain, earning Karma early is your best move.

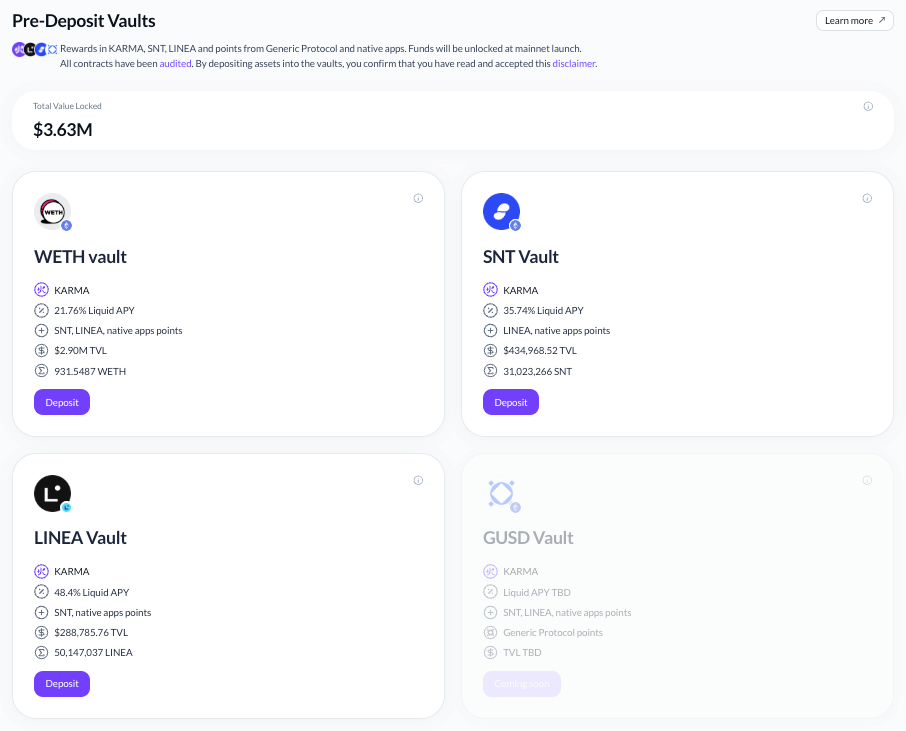

The pre-deposit phase continues straight into mainnet, with users able to deposit LINEA, ETH and SNT to earn rewards and liquid yield. Across all currently open pre-deposit vaults, approximately $3.7M in total value is locked.

On January 21, the GUSD pre-deposit vault opens:

- A yield-generating meta-stablecoin

- Deposit USDS, USDT or USDC to mint GUSD

- Karma and liquid yield accruing before launch

- Yield accrues to the funding pool - first vote on allocation by Karma holders at mainnet launch

ETH, SNT, LINEA, and GUSD together form the initial liquidity layer of Status Network. More assets will follow. Mainnet launch target: end of March.

Deposit LINEA: https://hub.status.network/pre-deposits

Learn more about Status Network: https://docs.status.network

Follow updates: x.com/StatusL2

Join the builders: t.me/StatusL2