What is DeFi? How does it impact your future?

Almost every facet of banking, lending, and trading is now managed through centralized systems run by regulatory organizations and gatekeepers. Consumers must interact with a slew of financial middlemen to obtain anything—from stock and bond trading to auto loans and mortgages.

KYC ("know your customer") is a process used by financial institutions to check a client's identity and legality before conducting business with them. In other words, the clients must demonstrate that they are who they claim to be. If you wish to borrow money from a bank, for example, you'll need a credit check, evidence of identity, and most likely some type of income verification.

As a result, customers have limited access to finance and financial services. They are unable to avoid the use of middlemen such as banks, exchangers, and lenders, who benefit from each financial and banking transaction. To play, each of us must pay a fee.

How it works

Decentralized finance (DeFi) is an ecosystem of peer-to-peer exchanges and services. It challenges the centralized financial system by disempowering intermediaries and gatekeepers and empowering common people.

Here's an example. Today, you can put your money into an online savings account and get 0.50% interest. The bank then lends the money to another customer at 3% interest, pocketing the 2.5% profit. People that use DeFi lend their savings directly to others, avoiding the 2.5% profit loss and earning the full 3% return.

You might think "Hey, I do this all the time when I give money to my friends via PayPal, Venmo, or CashApp." But you do not have this capability. To send money, you still need a debit card or bank account linked to those apps, thus even these peer-to-peer payments rely on centralized financial middlemen.

Imagine a world without banks; instead, a software program/code acts as a bank and is accessible to anybody. It doesn't require your trust (like you have to trust modern banks to not mishandle your funds), it's unaffected by censorship (unlike modern banks and financial services, which can still decide what you're allowed to do with your money), and most significantly, it is much less expensive than traditional banks.

This means that a consumer can remain anonymous and keep their personal information and identity hidden when using DeFi. In most cases, digital materials are all you require.

Instead of using banks, DeFi participants engage with a "smart contract," which is a software program that functions as an intermediary to ensure that everyone meets their obligations.

That is the future that those developing decentralized finance (DeFi) applications hope to achieve, one that will completely transform the financial system.

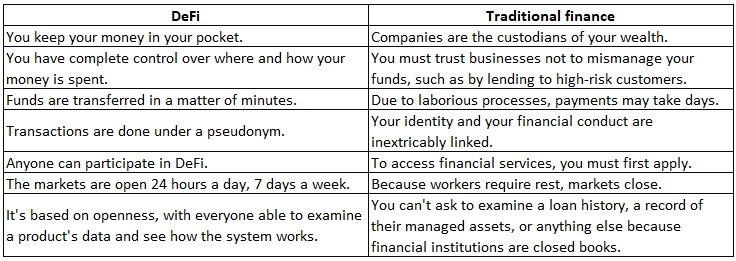

Understanding the issues of traditional finance is one of the best ways to appreciate the potential of DeFi.

- Some people are denied the ability to open a bank account or use financial services.

- People who do not have access to financial services may be unable to find work.

- Financial services may prevent you from receiving a payment.

- Financial services collect and sell your personal data.

- Markets can be shut down at any time by governments and centralized entities.

- Trading hours are frequently restricted to specific time zones' business hours.

- Internal human operations might cause money transfers to take days.

- Financial services command a premium because intermediary institutions require a share.

A comparison

But what exactly is DeFi?

DeFi is a decentralized, global financial system built for the internet era, providing an alternative to the current opaque, tightly controlled system which depends on decades-old infrastructure and processes. It provides you with comprehensive financial management and visibility. DeFi exposes you to global markets and gives you currency and banking possibilities that may not be available in your home country. Customers own and maintain the majority of DeFi services, which allow anyone with an internet connection to access them. DeFi programs have already handled tens of billions of dollars in Bitcoin alone! (and this figure is steadily increasing)

DeFi's mission is to employ decentralized technology to deliver many of the financial services that users and businesses presently enjoy, such as loans, interest on deposits, and payments. DeFi alters the industry not by changing what it does, but by changing how it does it. In other words, DeFi establishes a new infrastructure for the delivery of similar financial products and services.

It accomplishes this through the use of blockchain technology and smart contracts, among other methods. Blockchain is a type of ledger technology that keeps track of all financial transactions on a specific platform. Consider it a chronologically recorded running record of all transactions on that specific blockchain. Person A's payment to Person B on XYZ date would be timestamped in the ledger indefinitely.

Smart contracts—software programs that can hold cryptocurrency and interact with the blockchain according to its rules—are the foundation of DeFi.

Smart contracts enable DeFi by automatically executing transactions between participants. They execute their set of instructions once the contract's requirements are met.

DeFi allows trusted intermediates—like banks or brokerage firms—to take the position of trusted intermediaries in peer-to-peer transactions, allowing investors to profit from bitcoin. Payments, investments, lending, and other peer-to-peer transactions are all possible with DeFi.

How DeFi Is Being Used Now

DeFI is becoming more prevalent in both basic and sophisticated financial operations. It runs on dapps (decentralized apps), and protocols (other programs). The two major cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), are handled through dapps and protocols.

While Bitcoin is the most widely used cryptocurrency, Ethereum is considerably more adaptable to a larger range of applications, and consequently Ethereum-based code is used in a large number of dapps and protocols.

Here are a few examples of how dapps and protocols are being used right now:

• Conventional financial transactions: DeFi is already being used for payments, stock trading, insurance, lending, borrowing, and much more!

• Decentralized exchanges (DEXs): Most Bitcoin investors are now using centralized exchanges such as Coinbase or Gemini. DEXs let users conduct peer-to-peer financial transactions while maintaining ownership of their funds.

• E-wallets. DeFi engineers are developing digital wallets that can operate independently of the main cryptocurrency exchanges and provide investors with access to a variety of assets, including bitcoin and blockchain-based games.

• Stablecoins. While cryptocurrencies are notoriously volatile, stablecoins achieve stability by anchoring their value to non-cryptocurrencies (e.g. the US dollar, a common influence of stablecoins).

• Yield harvesting: dubbed crypto's "rocket fuel," allows speculative investors to lend crypto and potentially profit handsomely when the proprietary coins DeFi borrowing platforms pay them for consenting to the loan rise swiftly.

• Non-fungible tokens (NFTs): NFTs turn non-tradable goods like slam dunk footage or the first tweet on Twitter into digital assets. The previously uncommodifiable is now commodifiable thanks to NFTs.

• Flash loans: These are cryptocurrency loans in which monies are borrowed and repaid in one transaction. Does this seem counterintuitive? Here is how it works: Borrowers can profit by entering into a contract inscribed on the Ethereum blockchain (no lawyers required) that borrows funds, executes a transaction, and immediately repays the loan. The funds are automatically returned to the loaner if the transaction cannot be completed or will result in a loss. If you make a profit, you can keep it after deducting any interest or fees. Flash loans function much like a type of decentralized arbitrage.

The DeFi market assesses adoption by calculating what's known as locked value, which determines how much money is currently invested in various DeFi protocols.

The omnipresence of blockchain drives DeFi adoption: a dapp is globally available the instant it is encoded on the blockchain. While most centralized financial instruments and technologies emerge gradually over time, limited by regional economies' laws and regulations, dapps operate outside of these constraints, raising their potential reward—and also increasing their hazards.

The Future of DeFi and Status

DeFi's future appears bright, from cutting out the middlemen to turning basketball clips into digital assets with monetary value. Users will soon get more autonomy, allowing them to use assets in imaginative ways that appear unthinkable today.

We adore decentralized finance tools at Status, and we happily enable DeFi with one of our features: Private & Secure Web3 Browser. With the Web3 Browser, you're able to access the most up-to-date DeFi dapps, exchanges, markets, games, and more. More information about the browser can be found below:

- Earn, Save, Exchange with Defi: Access the growing ecosystem of decentralized financial tools and services all from your mobile phone.

- Games, Marketplaces and More: Play, collect, trade, and browse with all your favorite decentralized applications in one place.

- Community Curated Discovery with Dap.ps: Dap.ps is a third party dapp discovery solution that aims to create a fair, token curated dapp marketplace. Leveraging SNT and token economics, Dap.ps decentralizes the way we explore and find the latest DApps

Mobile DeFi takes financial sovereignty further into the future. Not only can you be the master of your own money, but of your own portfolio. It's up to you to set up your risk profile to capitalize on risky positions and hedge with safer ones. You do your own research, you do your own testing, you build your own portfolio based on your own comfort level, and you reap the rewards—no banks necessary!

And it's not just you. The Status Network's mission is to bring private secure communication and decentralized finance to communities that need it most—for example, communities under the thumb of oppressive governments that spy through apps and conduct warfare with their military and currency. We're building to give communities like this a chance to set their own financial priorities and build their own ecosystems.

Status has clear and specific principles that act as tools. Tools for thinking, for communication, and for decentralized decision making. They keep us honest about where we are failing short of our vision, click here to know more about our principles and mission.

Please don't miss out on this opportunity to be a part of this ecosystem and get the Status app now by clicking here.