The Defiant’s DeFi10 Fund by Camila Russo

The Defiant is the best daily email roundup with DeFi news, analysis, guest interviews, and more content around the rapidly growing DeFi space. At the start of 2020, The Defiant author Camila Russo took $1000, and put it into ten different DeFi platforms.

In partnership with The Defiant, we're reposting Russo's update from March 12th, 2020 to show the power of DeFi and introduce The Defiant as a great place for DeFi News and Analysis.

Camila Russo - originally published March 12

Hello Defiers! It’s a grim day for markets. Global stocks are plunging, bond yields are soaring, crypto is tanking, and not even supposed safe havens like gold are getting a break. I think it’s a good time to update you on how my DeFi10 portfolio is doing.

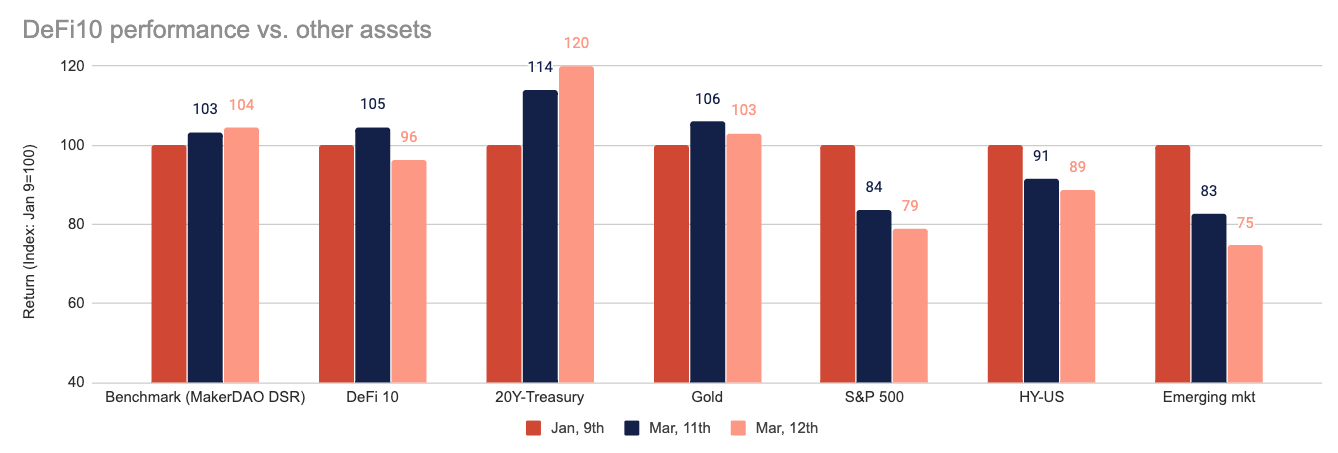

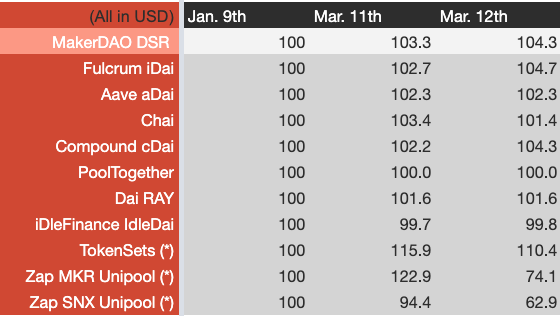

At the start of the year, I invested 100 Dai in 10 decentralized finance platforms, plus one benchmark for a total of 1,100 Dai, with the intention of testing a wide range of DeFi projects and also tracking their performance throughout the year. My requirement was that they be passive investments that I could just park to gain interest and/or fees. [Read my two posts here and here]. Nine weeks in and amid a horrible start to the year, the DeFi 10 is beating other risky assets. As of yesterday, it was up 4%, while most assets tanked.

I will continue updating you on the performance of this DeFi portfolio. Subscribe to be up to date on this and everything decentralized finance. Paid subscribers can join me on our new Discord chat group to discuss!

Decentralized finance is turning out to be a decent place to weather the storm —but don’t go as far as calling it a safe haven.

A portfolio of 10 investments in decentralized finance platforms plus a benchmark, which I call DeFi10, is outperforming risky assets including crypto, U.S. equities, high-yield bonds and emerging markets stocks. But amid the recent market bloodbath driven by worries that COVID-19 will cause a global recession, traditional safe havens are gaining, putting the DeFi10 behind gold and U.S. Treasuries.

Performance so far shows that passive investing in decentralized finance, which mainly consists of depositing digital assets in lending pools, and gaining interest from the loans being taken out of those pools, can prove to be less volatile than crypto, which means lower gains on the way up, but also minimized losses on the way down.

DeFi 10 is down 3% to $1,065 from the $1,100 invested on Jan. 9, outperforming the S&P 500 which plunged 16% in that time, and BTC, which is down 23%. Meanwhile safe havens like gold futures are up about 6% in that time.

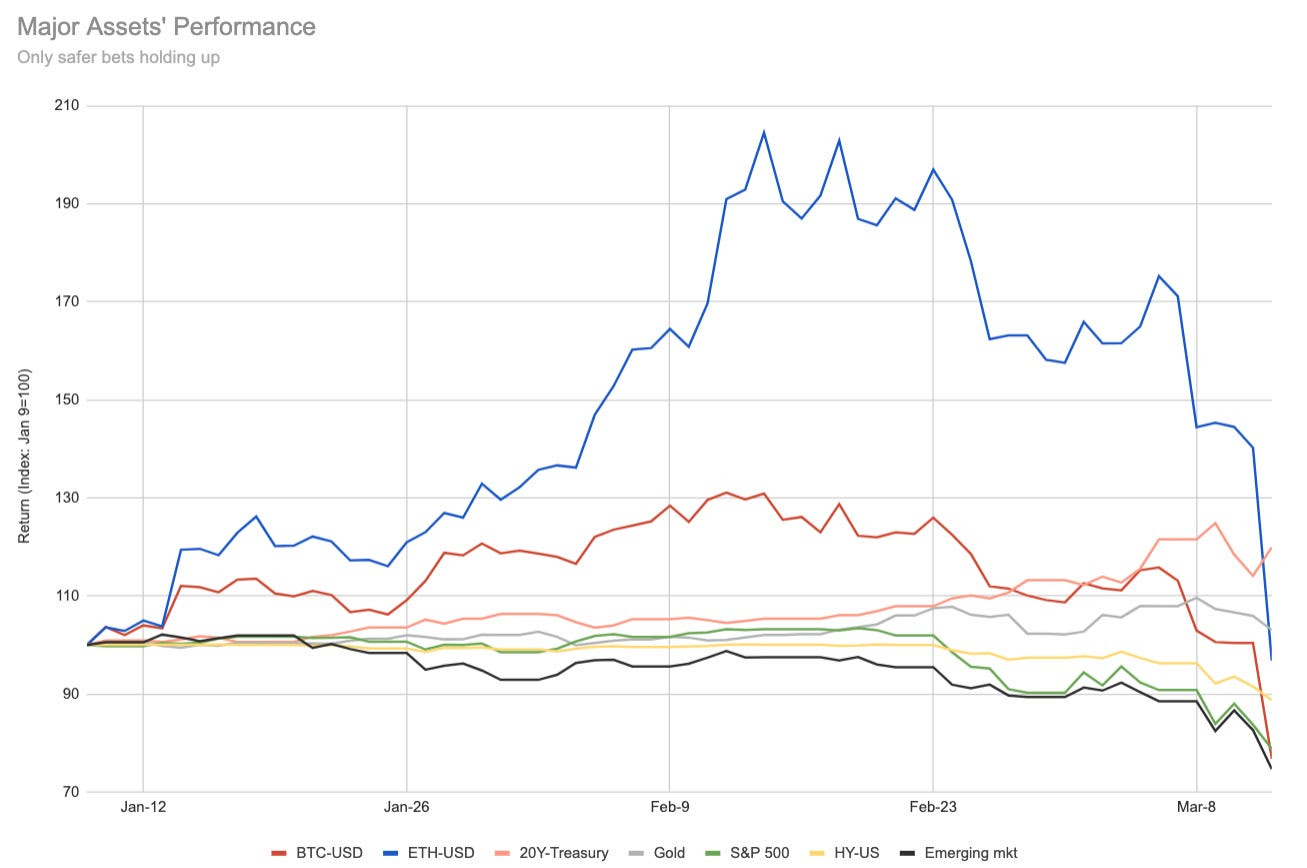

Image source: The Defiant, with data for major assets from Yahoo Finance

Just yesterday though, DeFi 10 was gaining 4% to $1,045. That’s because while eight of the 10 investments are in Dai, the stable coin that’s pegged at 1-to-1 with the dollar, three (i.e. 30% of portfolio weight) have exposure to ether. Volatility in the ETH-based portion of the portfolio explains the big swings. Taking out the three ETH investments and using only Dai-based, the portfolio would be up 0.3% in the past nine weeks (down from 1.7% until yesterday).

Here’s how the portfolio is made up:

Image source: The Defiant, ETH-exposed investments represented with (*)

The last three investments in that table —TokenSets, MKR Unipool and SNX Unipool— have an ETH-based component. With ETH plunging 28% just today, investments in Uniswap liquidity pools, which require holding tokens like SNX and MKR and also ETH, are dragging down the whole portfolio —DeFi10 would be up if it wasn’t for those two investments. The flip side is that when ETH was surging earlier this year, they were helping DeFi10 benefit from the crypto rally.

TokenSets is a different story. The platforms allows users to automatically follow different trading strategies. 10% of DeFi10 invested in the 20-day moving average for ETH. This means TokenSets automatically took my investment and switched it from ETH to USDC when the ETH price crossed under the 20DMA, and from USDC to ETH when is crossed over. This piece of the portfolio has shown the most consistent gains.

There’s a distinction to be made here between MakerDAO’s DSR and iDai, aDai, Chai and cDai tokens. DSR is short for Dai Savings Rate, and it’s the interest savers make for depositing their Dai in the MakerDAO system. The rate is decided in a vote by MKR token holders, and serves as a benchmark for the rets of the DeFi platforms. Right now, the rate is at ~8%. Tokens like cDai and aDai, issued by Compound Finance and Aave respectively, allow users to earn interest from lending their Dai via these platforms. Interest gets accrued directly on the tokens —it’s like holding a derivative of a savings account.

Surprisingly, almost no interest-bearing tokens was able to beat the benchmark, MakerDAO’s DSR. The main reason for this seems to be that the fees paid to exchange Dai for these tokens eat into the return, which I’m calculating from the initial 100 Dai investment. This may well be reversed if there’s a fee to pay for withdrawing Dai from MakerDAO’s Oasis platform at the end of the year, when this experiment ends. iDai, issued by Fulcrum, was the only one able to beat DSR, and that’s because interest rates offered by the platform spiked after it suffered a financial attack from arb traders.

Image source: The Defiant, with data for major assets from Yahoo Finance

Yield aggregators are an exciting new category emerging in decentralized finance. These projects allow users to deposit their funds, and have these platforms automatically distribute the investment across the DeFi platforms offering the best yield at any given time. The DeFi10 portfolio includes two yield aggregators, IdleFinance and Staked’s RAY. It’s worth noting that in this case, the return I’ve had isn’t the best representation of how these platforms work.

In both cases, I had to buy Sai (the old version of Dai, which is being phased out), because the platforms hadn’t upgraded to offer Dai yield aggregators. In the case of RAY I swapped 100 Dai for Sai, while in IdleFinance I swapped the equivalent of $100 in ETH for Sai, using Uniswap both times. I lost some money in these swaps, because of the exchange rate and because of fees, which lowered the amount I ultimately put in, and lowered the return. Judging only from the amount I put in, IdleFinance has delivered an impressive 7.8% return (from 92.5 Dai to 99.7 Dai).

Here’s a snap-shot of my previous post, which has a PDF with the steps needed for each investment. Source: The Defiant

The final investment to talk about is PoolTogether, the no-loss lottery. At PoolTogether, funds deposited to buy virtual lottery tickets are used to earn interest in DeFi. Every week, an address is picked to win the interest earned by the funds in the pool. It’s no loss, because you can always retrieve the same amount you put in. The 100 Dai I deposited for 100 tickets will be continually playing to win every week’s lottery. I haven’t won anything yet.

There are different platforms that connect to Ethereum wallets and help users track their portfolio, including DeFi Prime’s tracker, DeFiSnap, and Zerion. DeFiSnap was the only one I found was able to spot every single one of my investments. It also gives an easy way to visualize your history of transactions. It’s not great at seeing exactly what the gain/loss has been for each investment. DeFi Prime’s tracker was great for seeing this, breaking down investments by interest earned and annualizing the return.

I’m pretty proud to have been able to beat the S&P 500 with a full-fledged open finance fund (as unsophisticated as this one), which required no brokers or bank accounts.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

Click here to pay with DAI.There’s a limited amount of OG Memberships at 70 Dai per annual subscription ($100/yr normal price).

About the author: I’m Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins. (Pre-order The Infinite Machine here). I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.

Thanks to Camila Russo and The Defiant for lending us a fascinating dive into a great cross-section of various DeFi products and how they've been performing.

The Status App enables all of this DeFi functionality on mobile, while also paired with truly secure, private chat and easy dapp integration. The best way to get started is to grab the Status App and join us in the dap.ps chat channel #dap-ps, and start chatting with other DeFi early adopters.

Check out these DeFi Dapps dap.ps >>

*Disclaimer - This article was written for your entertainment, and the content is for informational purposes only. You should not construe any such information or other material as investment, financial, or other advice. Using decentralized financial tools does not come without risks and using Status is simply a portal to these tools - Status does not mitigate associated risks of said products.