Self-Sovereignty and the Transformation of Online Security

With the transition from a culture of customer service to self-sovereignty, our approach to security must adapt. Smartphones and the rapid adoption of mobile payments have enabled us to communicate and transact wherever we are, whenever we want. However, with the legacy systems at play, we trade off autonomy for the convenience they offer in things like fraud protection and password management.

Cryptocurrencies, DeFi, and distributed technology, on the other hand, offer us a path towards individual ownership and responsibility. Combining the convenience of smartphones and mobile payments with the liberating elements of crypto and decentralization, we are left with an imperative need to replace third party assurances. In this article, I will outline why new security tools, user experiences, and mentalities must play a role in our path to self sovereignty.

Distributed technology and cryptocurrencies enable individual autonomy and self sovereignty. This has been the rallying cry and ethos of the community since the advent of Bitcoin. However, while these systems present a means to individual autonomy, they require a shift in how we manage our online selves and our mentality towards online security – especially when it comes to protecting our funds. Simply put, cryptocurrencies as self-sovereign assets require a different level of responsibility compared to legacy financial systems.

“Sovereignty is the full right and power of a governing body over itself, without any interference from outside sources or bodies.”

However, self-sovereignty is a difficult concept for many people accustomed to a culture of customer service. Can’t access your funds? Call your bank. Notice a fraudulent charge on your credit card? Initiate a chargeback. Forgot your password? Reset it.

Smartphones open up a world of possibility and autonomy that has never existed before. The ability to connect, transact, and interact with people from all over the world directly from your pocket has changed the landscape of modern society. Most notably, we can access our finances and process transactions with the simple tap of a button. And now with Apple Pay, Google Pay, Samsung Pay and the myriad of “Super Apps”, we can engage in global and local commerce from our smartphones.

As of September 2019, there were approximately 441 million Apple Pay users worldwide, up from 292 million users in the corresponding period of the previous year. Samsung Pay and Google Pay are expected to reach 100 million users each in 2020.

Now you may notice the issue here. Yes - mobile payments offer unparalleled convenience, but how autonomizing are they when operated by the some of largest centralized corporations in the world with financial incentives strongly misaligned with the sovereignty of their users? Further, many of these mobile payment systems rely on legacy rails and middlemen which have been met with pushback as seen by WhatsApp Pay in Brazil.

If smartphones and mobile payments removed the limitations of desktop and location requirements, then the addition of cryptocurrencies and decentralized technology enable self-sovereignty. Crypto, DApps, and DeFi alleviate many issues caused by trust in a handful of centralized companies storing our passwords, serving our messages, and processing our transactions.

Adoption of self-sovereign assets has exploded as of late. Stablecoins and DeFi protocols provide options to earn and save on each individual’s own terms. With over $1.55B locked in defi protocols, Bitcoin and Ethereum ATM’s popping up all over the world, and the introduction of crypto point of sale terminals, cryptocurrencies are on the way to becoming commonplace in our daily lives.

As adoption increases, and our reliance on third parties decreases, it is imperative that we build bridges between users and decentralized best practices – especially when it comes to securing our funds. Without the centralized third parties, we no longer have the assurances of chargebacks, fraud protection, or password resets. We not only need to build new tools and user experiences, but there needs to be a complete shift in how we think about protecting our accounts and funds – after all, we are now totally responsible.

Many crypto companies have opted to open services to centralized banks through card payment rails, government insured deposits, and centralized password database backups. The justification is that using centralized services is a bridge between the present and the future, and that some decentralization is better than no decentralization. Of course, it is up to each service provider and each user to decide what level of centralization they are comfortable with.

However, as we further decentralize the service we build, it is crucial that we build better experiences that help people move toward secure digital behaviors for these services that require more effort and understanding for the end user. Where can we use technology to meet new users midway?

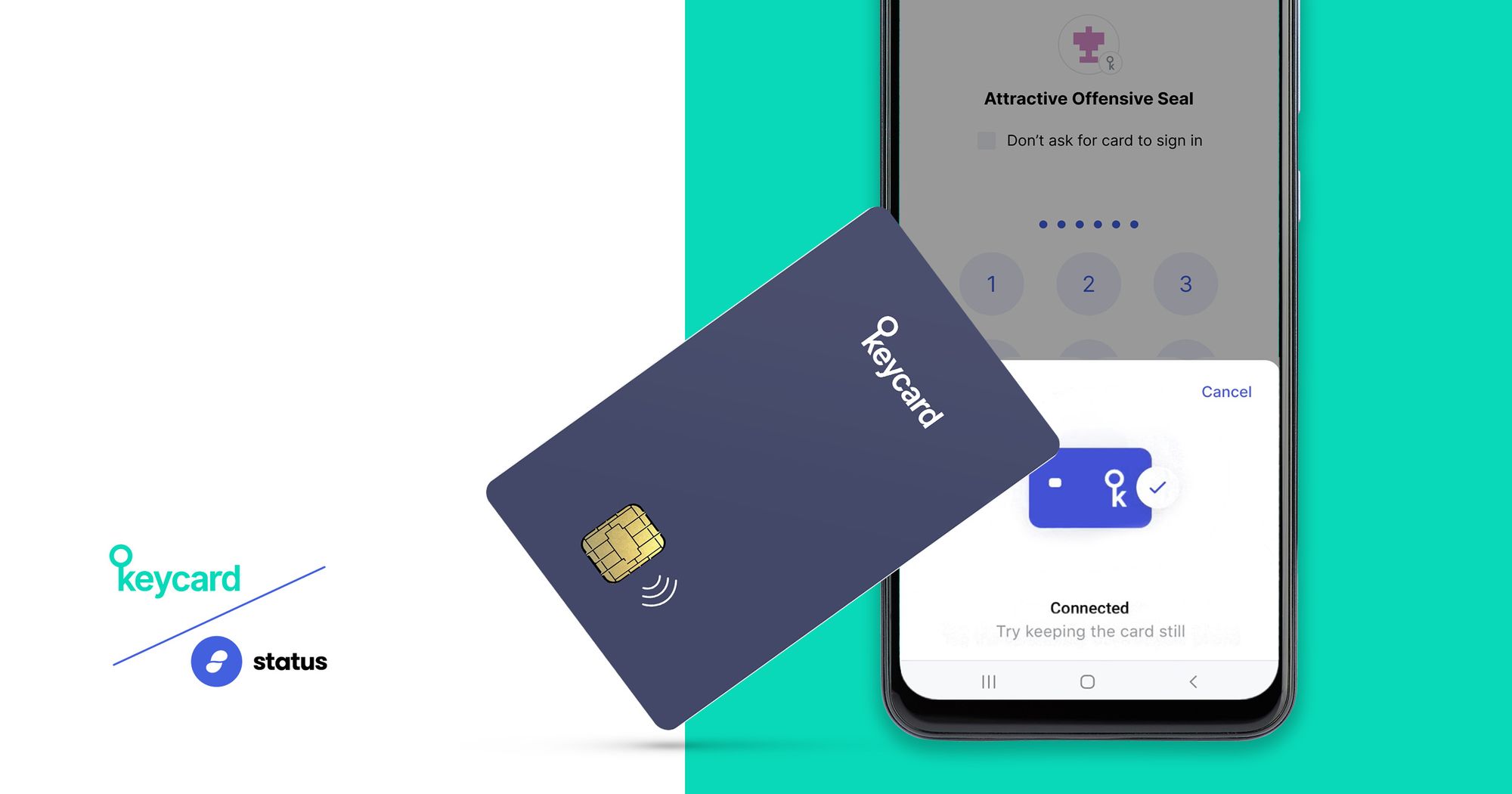

Cold storage and hardware wallets including Ledger and Trezor offer a secure way for users to store their funds in an air gapped environment. However, they introduce a severely foreign UX for crypto newbies and come at the expense of convenience in that they must be plugged in through a cable. What good is a USB-like hardware wallet for storing my private keys offline, if I am going to be transacting regularly with crypto currencies on a mobile device?

The world, Ethereum, and DeFi are going mobile. Therefore, we need to bring the security of crypto hardwallets to mobile and allow anyone to use sovereign financial tools with confidence. There also must be a shift in our mentality towards mobile security. Today, we use our credit cards and casually sign receipts as a form of authentication, understanding that our banks are always there to rectify fraudulent charges or errors. We have grown accustomed to caring very little about the security of our day-to-day transactions.

We need user experiences that remind us that we are always in control of our assets in conjunction with the tools that make this experience as simple, seamless and familiar as possible. Make it easy to be safe.

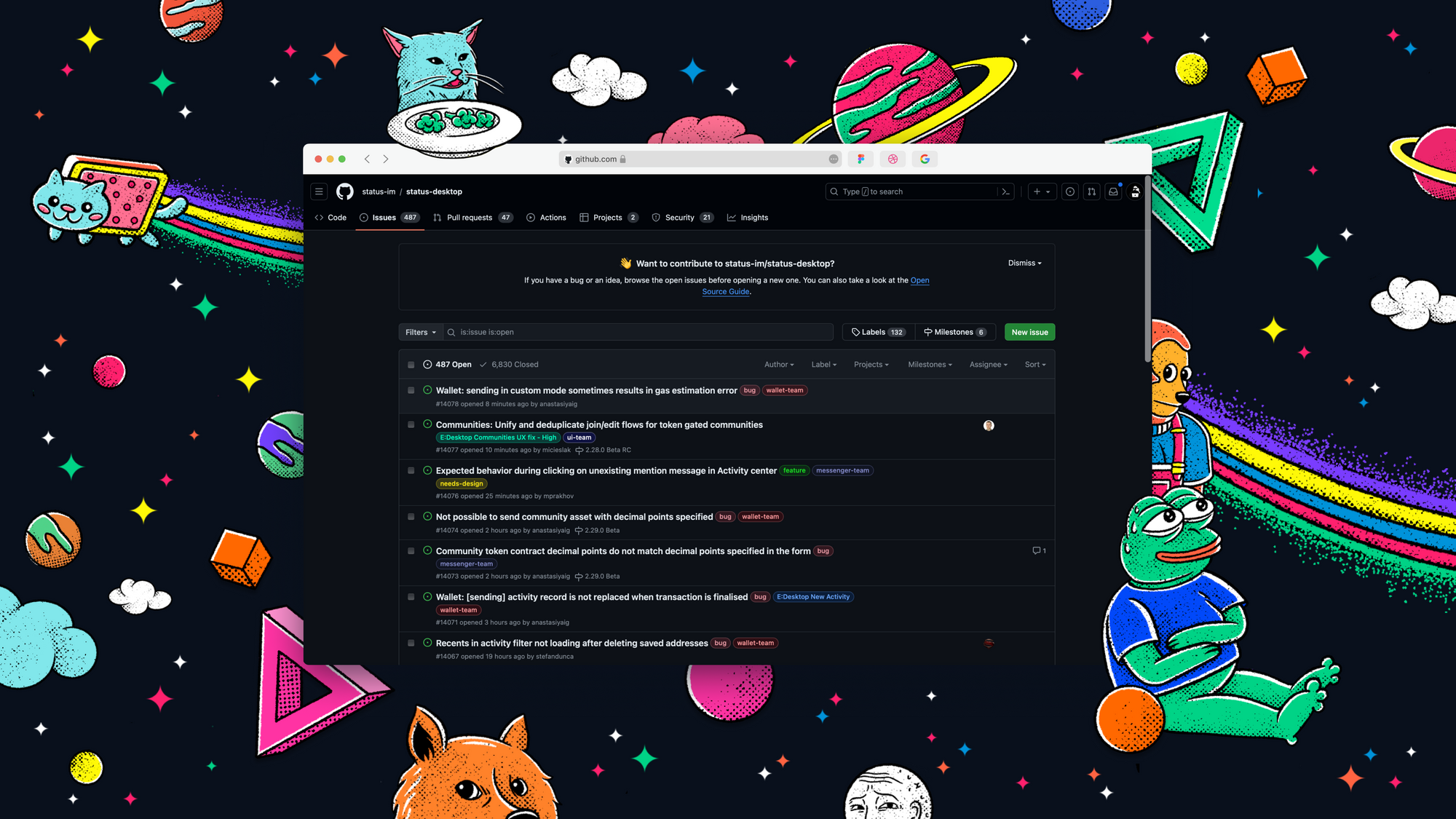

As mentioned, projects like Ledger, Trezor, and other forms of cold storage have made holding and managing crypto assets more secure. Projects like Zerion, DefiSnap, and Aave have made managing your crypto portfolio simpler and more seamless from your mobile phone. At Keycard, we built a secure hardware wallet with a credit-card like design, to safely store private keys offline for increased security and provide a contactless experience with crypto for a more familiar user experience. It recently integrated with Status Mobile App, the integrated private messenger, Ethereum wallet, and Web3 dapp browser,

The bridge here is bringing familiar card experiences in line with crypto security best-practices. The shift in mentality is users taking the onus upon themselves to secure and protect their accounts and all of their transactions. As we move further into a decentralized world, with self-sovereign crypto assets, we can no longer simply rely on centralized third parties to back up our accounts and funds. Instead, we must adopt a new mentality when it comes to our accounts, assets, and property – one in which we truly are autonomous and responsible.